When I first began writing about fashion, beauty, and wellness, it wasn’t just because I admired the artistry and craftsmanship of these pieces or the elegance I saw on the runway.

I was captivated by how fashion allowed me to express my multifaceted self and now, more than ever, wellness has become a part of that expression.

But beyond the beauty, I found myself drawn to the brilliant business minds shaping these brands and the immense value they bring to the world.

These industries offer incredible potential for disruption, yet I’ve noticed an intense focus on rapid growth, which has started to hurt the luxury sector.

Brands once revered for their exclusivity are now, in some cases, associated with overexposure and a loss of allure.

I am seeing also a lot of tech investments across these industries but who are the companies excelling at this? And what are the funds and family offices leading the way. Let’s discuss this more in-depth next week.

But, there is indeed a big list of factors contributing to the fall out of legacy corporations.

🌟 fashion🌟

Let’s face it: recent weeks have been tough for luxury. Just look at Tapestry, which was blocked by the U.S. courts from acquiring Capri Holdings.

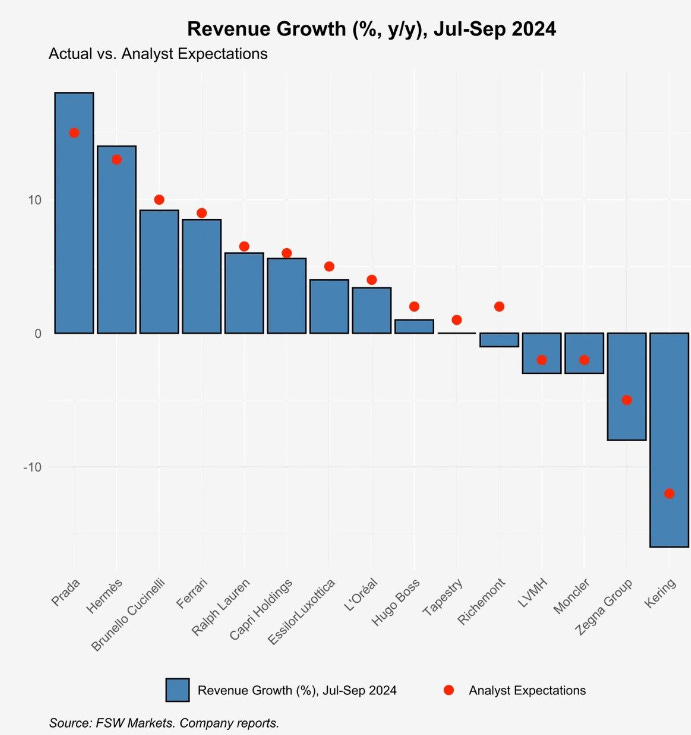

But what captures the current state of the luxury market best is the image below:

So, let’s pivot to something uplifting and because it’s relevant.

RALPH LAUREN: ITS TIMELESS MAGIC PAYING OFF

Last week, I posted about Ralph Lauren's unique, enduring appeal, a legacy built by staying true to a strong brand identity.

I've always admired how the brand captures the spirit of the American West, woven deeply with cowboy culture. Inspired by Ralph Lauren’s love for Western films, this influence has become as iconic to the brand as its preppy aesthetic.

And Ralph Lauren is only moving upward because, as he once said:

"I don't design clothes. I design dreams."

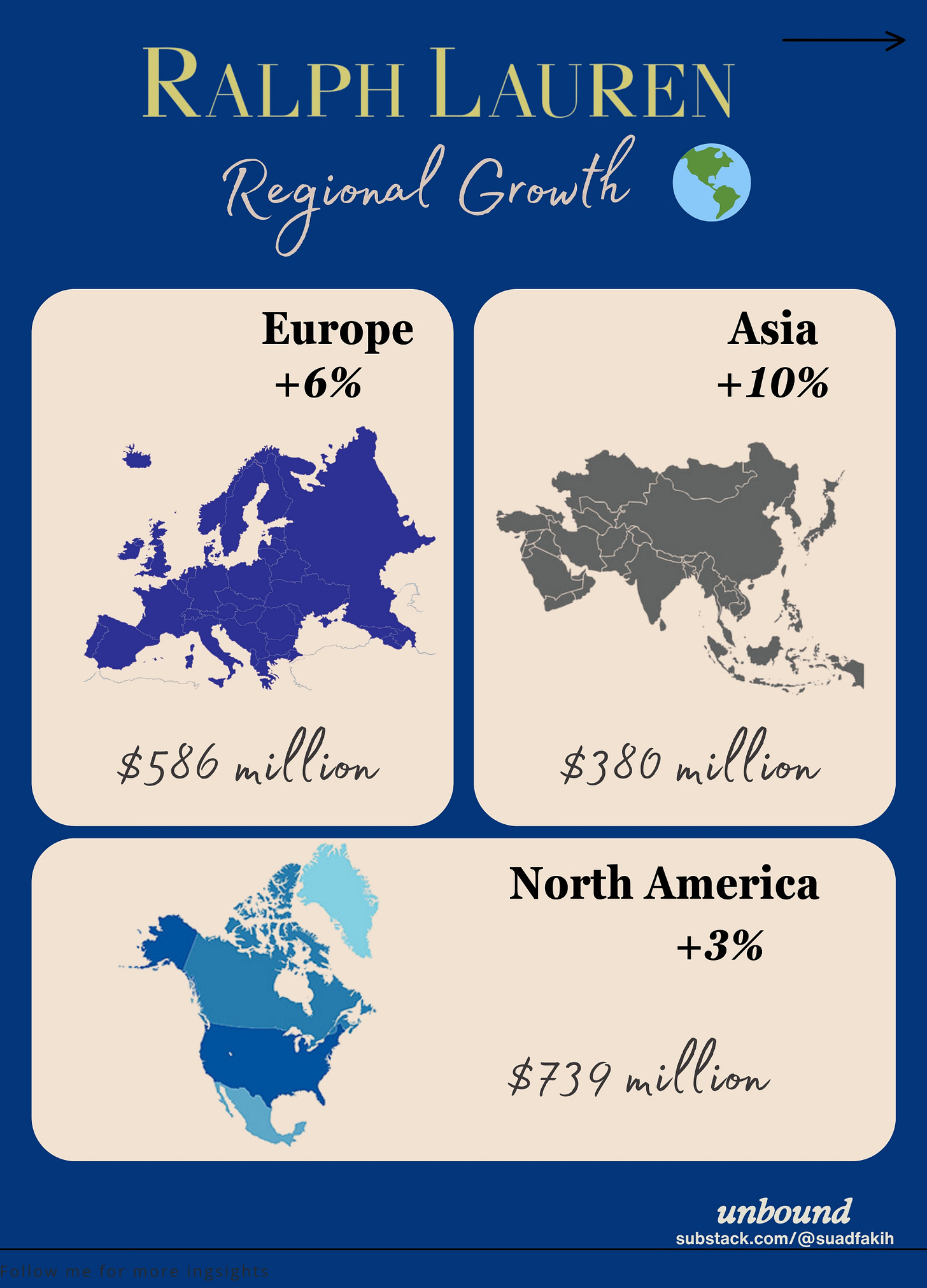

Let’s take a look at what's driving demand and which regions can’t get enough:

So, what makes Ralph Lauren such a successful brand?

Over 55 years of a strong, consistent brand identity

Timeless style paired with a reputation for quality

Exceptional storytelling that connects with audiences’ emotions and interests

Staying culturally relevant by tapping into nostalgia—from American folklore to the revival of the 1990s Polo Stadium Collection

Financial discipline with a focus on capital allocation and optimization

Digital engagement that resonates with younger audiences (see examples below)

Meanwhile on the fast fashion world, Shein, continues to reign:

🪷beauty🪷

I want to share a list of companies in the beauty/beauty-tech that recently raised:

OneSkin - A U.S.-based beauty brand focused on anti-aging products, raised $7M for their Series A.

Booksy - A U.S. beauty and wellness platform for booking appointments, receives growth financing of +$100M for their Series C led by CIBC Innovation Banking.

Secret Alchemist - An Indian wellness and beauty brand, secured $500K in seed led by Inflection Point Ventures (IPV), a Gurugram-based angel investment firm.

Tribeau - A Japanese app to search for reviews/procedures/clinics, receive online counseling, and book with clinics in cosmetic surgery, cosmetic dermatology, and cosmetic dentistry. Raised $11.3M in Series C funding by Minerva Growth Partners, Nissay Capital, and others.

Indu - A UK-based teen-first skincare and cosmetics brand secured £4 million led by Unilever Ventures and V3 Ventures to support its retail expansion.

🤖tech🤖

CROISSANT: TURING YOUR SHOPPING INTO LIQUID ASSETS💸

In 2023, Croissant launched with a bold vision armed with 𝐰𝐢𝐭𝐡 $24𝐌 𝐢𝐧 𝐬𝐞𝐞𝐝 𝐟𝐮𝐧𝐝𝐢𝐧𝐠: give shoppers a guaranteed resale value at the point of purchase.

𝐖𝐡𝐚𝐭’𝐬 𝐭𝐡𝐞 𝐁𝐢𝐠 𝐈𝐝𝐞𝐚?

Imagine turning your everyday shopping into liquid assets ready to resell with just a tap. No hassle, no guesswork, just pure transparency.

𝐖𝐡𝐲 𝐢𝐭 𝐰𝐨𝐫𝐤𝐬?

🔥Retailers gain resale benefits without lifting a finger on second-hand inventory management.

🔥Shoppers feel incentivized to buy more if they know exactly when and how much they can resell their purchases.

🔥𝑅𝑒𝑠𝑢𝑙𝑡𝑠: 50% increase in average order value for partnered retailers like Nieman Marcus and Shopbop, to name a few.

🔥𝑇𝑟𝑎𝑐𝑡𝑖𝑜𝑛: +26k customers on-boarded.

𝐈𝐭’𝐬 𝐦𝐚𝐠𝐢𝐜?

Croissant isn’t competing with The RealReal.

Instead, it’s “resale-adjacent”—bridging retail and the $2.1 trillion resale market by offloading inventory onto other second-hand platforms.

It’s a fresh approach that reframes shopping from debt-driven splurging to asset-based investing.

Shifting consumers' mindsets from debt-fueled spending to asset-based purchasing.

𝐖𝐡𝐲 𝐢𝐭 𝐦𝐚𝐭𝐭𝐞𝐫𝐬?

Changing consumer perception is key, and they accomplish this by positioning each shopping experience as an “investment.”

Croissant Address Key Pain Points in Resale:

🌀Ensures 100% transparency for both buyers and sellers.

🌀Reduces authenticity issues (counterfeit market - $1.7 trillion)

🌀Offers users frictionless "liquidity" to consumer

🌀Eliminates supply chain logistics and inventory management for its retail partners

𝐁𝐮𝐭, 𝐝𝐨𝐞𝐬 𝐭𝐡𝐢𝐬 𝐦𝐚𝐤𝐞 𝐟𝐚𝐬𝐡𝐢𝐨𝐧 𝐚𝐧 𝐈𝐧𝐯𝐞𝐬𝐭𝐦𝐞𝐧𝐭? 🤔

Calling every purchase an “investment” is a stretch; only a few items appreciate over time – like a Birkin bag.

Croissant’s Instagram shows that full returns on purchases are very rare.

𝐂𝐡𝐚𝐥𝐥𝐞𝐧𝐠𝐞𝐬 𝐀𝐡𝐞𝐚𝐝: Blockchain & DPP Compliance

The EU’s Digital Product Passport is to be implemented by 2026.

This regulation requires full traceability and transparency throughout a product’s lifecycle.

Unlike competitors like Aura Blockchain Consortium, backed by LVMH and Richemont, Croissant’s lack of blockchain technology might make it hard to meet these stringent standards, especially for brands with a big exposure in Europe.

Full analysis on my LinkedIn.

🤑 venture capital 🤑

Recently, Peter Walker, Carta’s Head of Insights, made an interesting assessment of the VC industry, and I couldn’t agree more with it:

As we head towards the end of the year, I'm having a lot of conversations with founders about "when will VC pop back".

They want to know when fundraising will get easier, especially outside of AI companies. They want to peer into the future and find that magic date when all of this sluggishness will fade.

But it won't - because now is normal.

So far in 2024, US companies on Carta have collectively raised about $21 billion per quarter.

Last year it was $18B. In 2020 it was $22B.

In relation to 2021's $55 billion, sure things seem dire. But that comparison point is screwing with our collective mental models. If we just wave a wand and erase our most recent bubble behavior (6 wild quarters), the mood around venture would change.

Yes, we would expect to see some gradual growth over time (as the market expands both on and off Carta). And yes, the gap between the upper range and the median for these companies is as large as ever.

This feels hard because it is hard! And because the quality of the founders on either side of you has never been higher. It's like swimming in a pool of Olympic swimmers - even great founders can feel lesser than.

Optimistic about 2025, but we are in the new normal now and it's unlikely to shift dramatically. Time to build!

I’d only add that building companies today is increasingly about smart capital allocation and crafting sustainable business models.

It's no longer just about growth; it's about longevity and resilience.

💌 startup & brand hacks 💌

TIKTOK: PERSONAL AND CULTURAL RELEVANCE DRIVES SUCCESS

Key lessons from their latest report:

Cultural relevance = significant growth. TikTok says high cultural relevance = 6x more growth. Cha-ching!

Media is fragmented - consumers only engage with what interests them. Be relevant, or get ignored!

Relevance = personal connection + community vibe. To succeed, it is critical to understand the real needs, passions, and conversations they truly care about.

Cultural relevance is linked to the conventions and expectations of communities. Personal relevance is about fitting the individual.

To solve that pesky "attention crisis," create personal and relevant ads.

For cultural cred, Track community trends and keep it real. For a personal touch, use humor and introduce new things.

TikTok is the trend-spotting goldmine. Its "For You" feed serves up relevance on a platter.

🍫 inspo🍫