🌟 fashion & tech🌟

I write about fashion because it’s more than just clothes and glitz—it’s an economic powerhouse.

Yet, fashion is often dismissed as “superficial” or “frivolous.”

But here’s the truth: Fashion is a $2.5 trillion global industry and one of the world's most complex and competitive business landscapes.

Why?

A few giants dominate the market. (For example, in luxury, just four companies control 98% of the profits of high-end fashion.)

Barriers to entry are sky-high and highly costly to newcomers.

The gap between creative talent and business know-how is still huge.

But despite these challenges, I see something powerful: a shift toward democratization and innovation.

Survival of the Fittest: Zara vs. Shein

Take Zara, for example. It ruled fast fashion for years until Shein rewrote the playbook, creating a new category: ultra-fast fashion.

Shein’s rise wasn’t luck; it was a calculated strategy:

Faced with this disruption, Zara had no choice but to adapt.

Following its successful campaign with Kate Moss, Zara is venturing into affordable luxury to increase its customer base and the average ticket spent.

As Susanna Nicoletti said about the new business strategy they are focused on:

…enhancing a high brand image while keeping the very democratic approach but also constantly improving the customers experience in order to make it as flawless as possible.

They also pay attention to their customer’s new preferences for sustainability investments to prepare for new legislation.

The lesson? No company can rest on its legacy. The future belongs to those willing to evolve.

Fashion’s Next Frontier: AI-Driven Insight

This brings me to an interesting fashion tech move this week: Heuritech’s acquisition by Luxurynsight Group.

What happened?

Heuritech, an AI-powered trend forecaster, joined forces with Luxurynsight, a data powerhouse trusted by brands like LVMH, Chanel, and Dior.

Why it matters:

By combining Heuritech’s real-time social media analysis with Luxurynsight’s market data, brands will gain unmatched trend prediction power. Think:

Smarter product launches

Faster market responses

Sharper competitive strategies

The bottom line: The fashion industry is becoming more data-driven than ever. And while creativity will always matter, technology will provide a competitive edge.

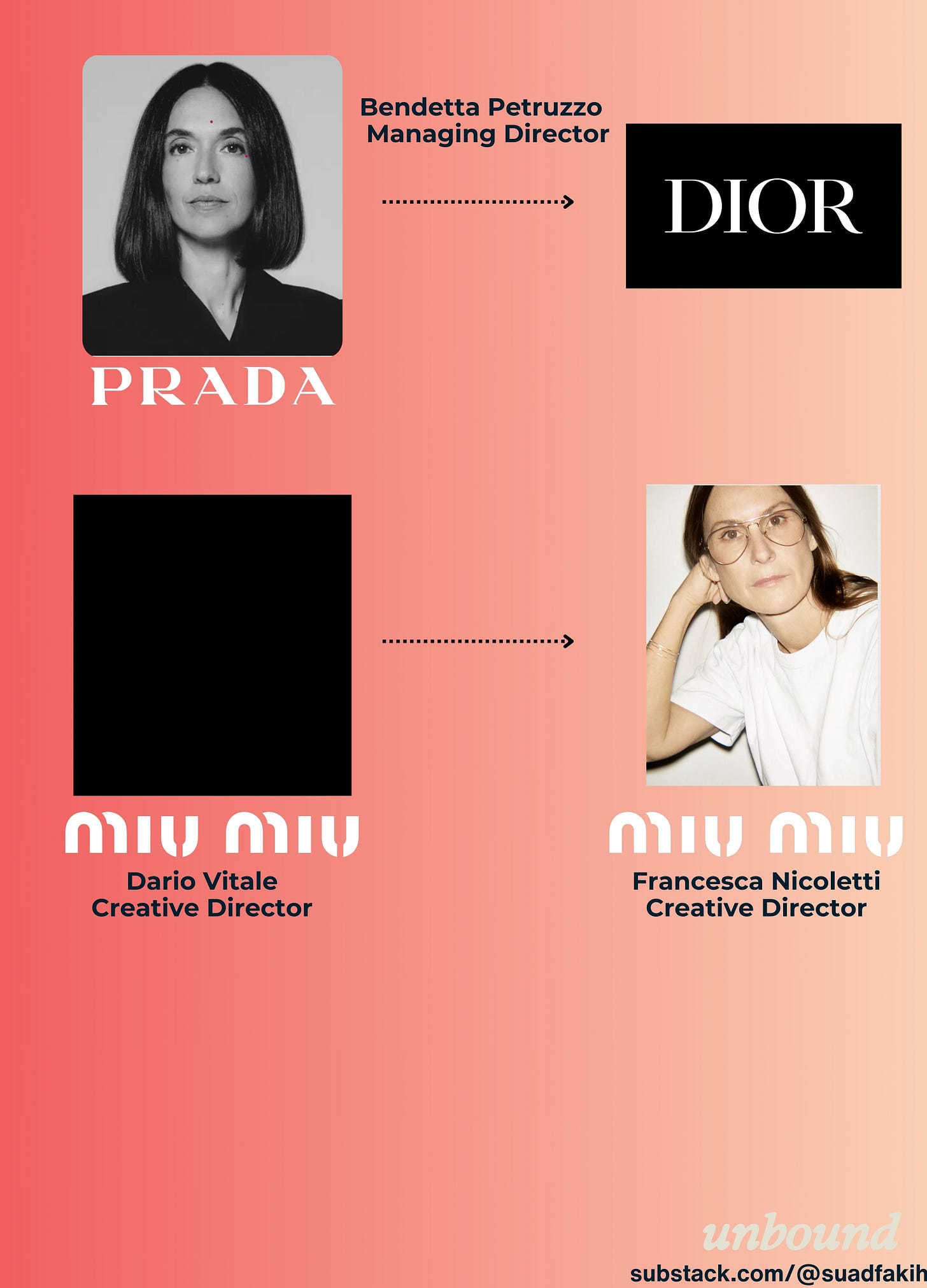

Musical Chairs Continue to be the Talk of Luxury

So much change has happened and continues to occur in luxury as the industry struggles.

Is it about finding a savior or looking structurally at and addressing industry challenges?

I’ll let you be the judge of that.

🪷beauty & investment🪷

Are Beauty Investors Expecting 90% Margins to Pull the Trigger?

Beauty Independent recently published an intriguing article exploring Flamingo Estate’s founder’s experience after 160+ investor meetings.

He said many VCs appeared fixated on 90% margins, leaving little room for brand stories or purpose-driven narratives.

But is this perspective reflective of the entire investment landscape?

One of the most insightful takes came from Cristina Nuñez, Managing Partner at True Beauty Ventures. Her perspective cuts through the noise and highlights what makes a beauty investment worthwhile beyond just chasing sky-high margins.

Violette_FR Raises $20M Series B: In a Challenging Environment

What VCs are backing the round?

Silas Capital

Experienced Capital

Monogram Capital Partners

Felix Capital

This funding round is particularly noteworthy given the current climate for beauty startups. Fundraising for beauty brands has been challenging lately, with investors tightening their purse strings.

Why? Beauty industry fundraising has slowed in 2024 due to market saturation, economic challenges, and shifting investor priorities towards profitability and proven efficacy.

With +1M loyal social media followers, Violette_FR has tapped into something beauty’s biggest players often miss—the crucial importance of authenticity and individuality.

The funding will fuel global expansion, sustainability initiatives, and product innovation, but the challenges are clear. Consumers demand more. They want clean beauty (a $400M category), science-backed products, and brands that align with their values.

What’s the endgame for a brand like this? Likely acquisition.

Most indie brands are acquired by larger players or private equity firms.

Here’s the real question: Can a brand built on authenticity thrive in a beauty industry driven by highly sophisticated customers?

🍫 inspo🍫

Lastly, some food for thought…