The Drop

curated insights: fashion, tech, beauty, wellness and biz

🌟 fashion🌟

Prices just keep going up

In the luxury world, steep price hikes, averaging a whopping 54%, are becoming the norm. But this strategy isn’t just about covering costs; it’s about boosting margins.

And here’s the twist: it’s backfiring.

The Fallout:

Cooling Demand in China: Once a goldmine for luxury, China’s economic recovery is dragging, with stimulus efforts offering little relief.

Aspirational Buyers Alienated: Many are ditching luxury giants for affordable premium alternatives like Polène, known for its high-quality, artisanal handbags crafted in Ubrique, Spain.

Shift in Perception: Consumers now prioritize craftsmanship, ethical production, and authenticity over loud logos.

Sustainability as Non-Negotiable: Transparency across supply chains is a must as consumers demand accountability.

Social Media Backlash: Viral complaints about poor craftsmanship and cheap hardware are denting reputations.

Digital and Omnichannel Engagement: Brands must embrace seamless online-to-offline experiences to survive.

AR, VR, and Personalization: Cutting-edge brands like Chanel are reshaping engagement with virtual showrooms and bespoke services.

Resale Market Growth: Gen Z and millennials, favoring circular models, are driving demand for rental and resale services like TheRealReal.

Cultural Relevance Matters: Tapping into regional identities is now crucial for maintaining global desirability.

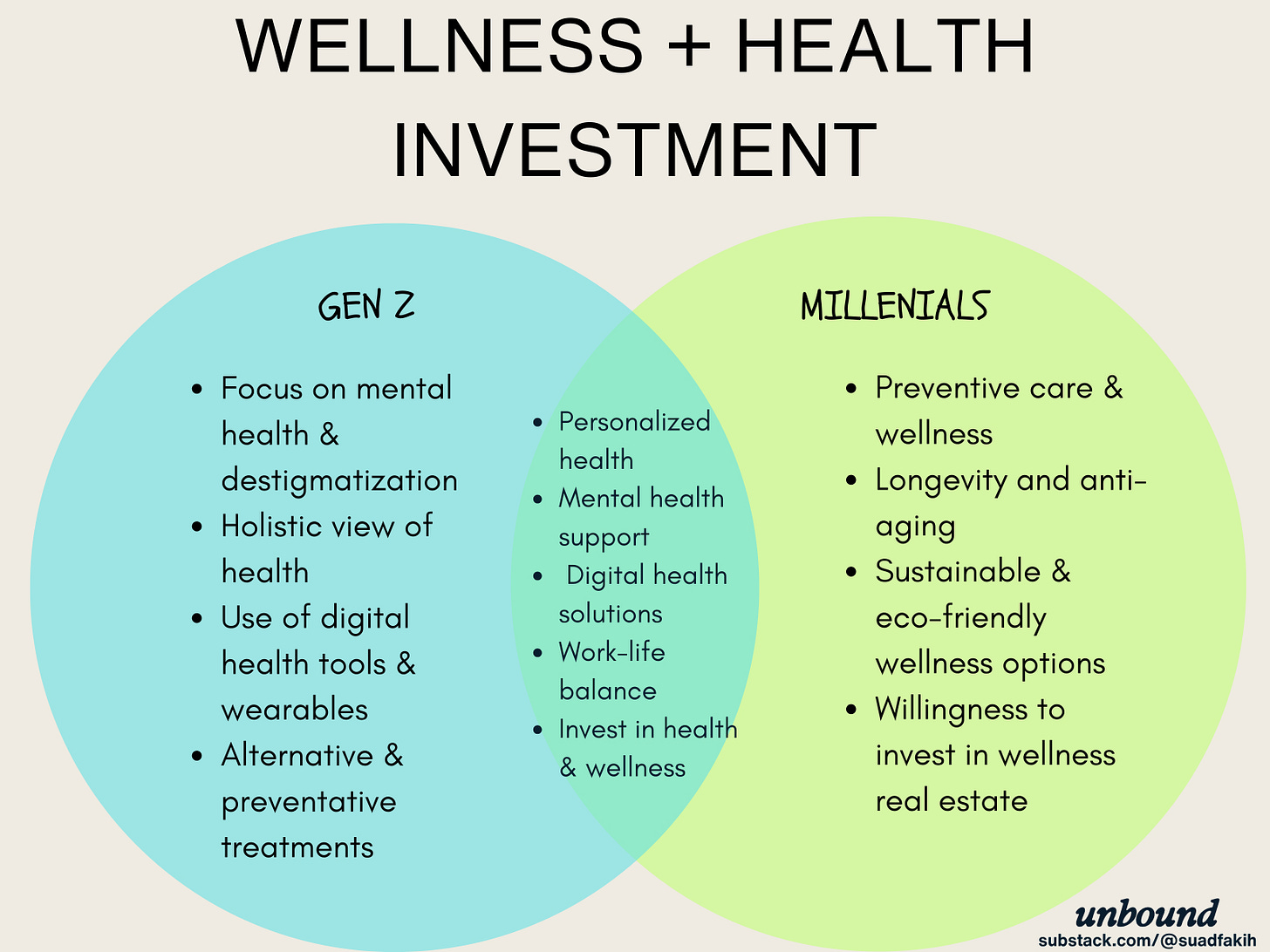

The Wellness Boom: Luxury spending is shifting to the $1.8 trillion wellness market, with high-net-worth individuals investing in personalized health experiences. This trend signals a cultural shift where well-being and longevity have become the new status symbols, superseding traditional material goods.

The luxury market is undergoing a shake-up, and brands that fail to adapt risk losing relevance and market share.

One space brimming with opportunity is beauty, which is no longer just about makeup and skincare but is now deeply intertwined with wellness. For luxury brands, tapping into this shift is essential.

LVMH’s Struggles: Overexposure and Market Fatigue

Despite its empire, LVMH reported a 5% drop in fashion and leather sales in Q3, dragging overall group sales down 3% to €19.1B. Analysts had predicted modest growth, but this decline—the first since 2020—highlights deeper market issues.

Overreliance on China: With sales in Asia (excluding Japan) down 16%, LVMH’s strategy is faltering. Even Japan, a hotspot for Chinese tourists, saw growth cool from 57% to 20%.

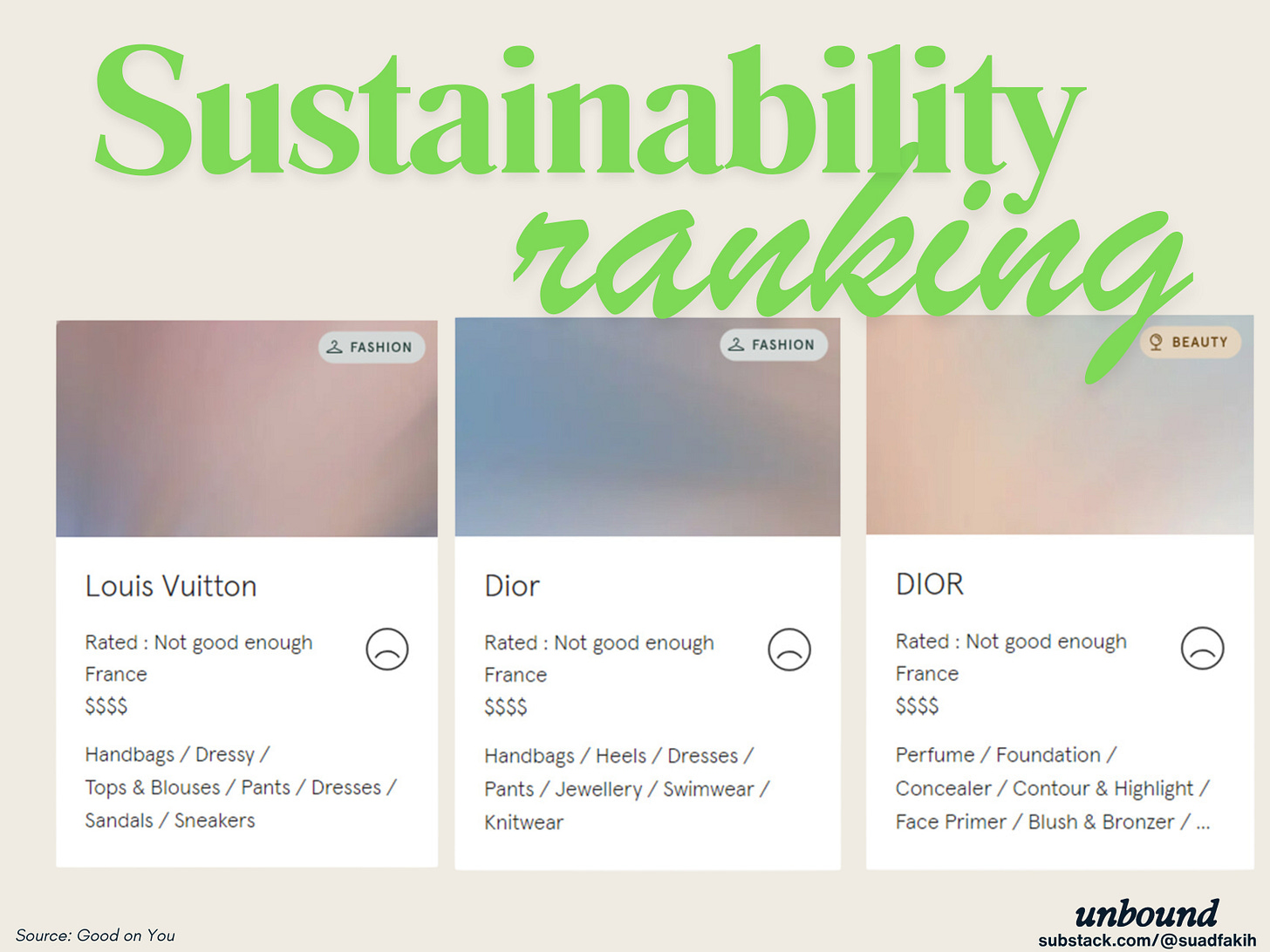

Luxury Fatigue: LVMH’s top brands, Louis Vuitton and Dior, are struggling as consumer confidence and aligning with new consumer values.

Let’s explore how Louis Vuitton and Dior are rated on Good On You, a platform that provides comprehensive sustainability and ethical scores for fashion and beauty brands.

Creative Shake-ups: To revive Dior, the brand brought in Jonathan Anderson, the genius behind Loewe's resurgence, signaling a bold attempt to inject new energy.

Image: Miss Tweed

Iran Amed, BoF Founder and Editor-in-Chief, summarized it best:

Ferragamo: Struggling to Find Footing

Ferragamo’s Q3 2024 results paint a grim picture, with revenue dropping 9.6% to €221M, and Asia Pacific sales falling 20.5%. The brand’s core categories: footwear, leather goods, and apparel—all saw double-digit declines. CEO Marco Gobbetti warned that macroeconomic challenges will likely push full-year results to the lower end of forecasts.

Ferragamo’s struggles reflect broader issues in the luxury sector, mirroring declines seen by Kering and Burberry. It’s clear that adapting to new consumer expectations isn’t just optional; it’s essential.

Gucci’s Leadership Shake-Up and Ongoing Struggles

Gucci is facing persistent challenges despite recent leadership changes. With Stefano Cantino stepping in as CEO, the brand hopes to regain momentum. However, uncertainty looms as its marketing strategies evolve without a clear direction, leaving questions about the brand’s future. Adding to the turbulence is speculation about whether the current creative director will remain, making it unclear how Gucci will navigate these ongoing challenges.

While some brands stumble, other brands are on the rise.

Brunello Cucinelli: A Beacon of Stability

While others flounder, Brunello Cucinelli is thriving. Revenues hit €620M in the first half of 2024, a 14.1% boost, and profits soared by 31.1%. The brand’s philosophy of “Humanistic Capitalism,” blending traditional craftsmanship with social responsibility, continues to resonate.

Regional Strengths: High demand in the Americas and Asia fuels growth, with rave reviews at Milan Fashion Week.

Sustainable Expansion: Investments in Solomeo’s production facilities position the brand to meet demand without compromising quality.

Quiet Luxury Defined: Cucinelli’s fusion of artisanal tradition with understated elegance makes it a standout in today’s shifting market.

Cucinelli’s strategy is a masterclass in staying relevant by embracing sustainability and authenticity, two things today’s consumers crave.

Nonetheless, I also revised the brand on Good on You and was very disappointed.

Hermès: Playing the Long Game

Hermès expands its portfolio by acquiring The Cavalier, strategically positioning itself for growth and expansion.

Jacquemus:

Celebrated its 15th anniversary with bold moves, launching its first New York store as part of a broader expansion strategy.

The New & Existing Power Players to Watch

Luxury is evolving fast. Millennials and Gen Z, who will control 70% of the market by 2025, are rewriting the rules. They favor accessibility, sustainability, and personalized experiences. They also view health and wellness as integral parts of their lifestyles and worthy of investment.

🤖 Startups 🤖

The New & Existing Power Players to Watch

Exits in the startup world are drying up. Nearly 40% of startups have been stuck in VC portfolios for over nine years, with IPOs and M&A deals becoming rare. To unlock value, VCs like General Catalyst and NEA are deploying continuation funds, offering liquidity while retaining stakes in high-potential companies like Stripe.

🤑 venture capital 🤑

However, startups are not the only ones struggling. VC funds have also had a rough run:

Despite challenges, several funds are raising capital to ride the next wave of innovation:

Node.vc raised €71M, focusing on AI and future-of-work solutions.

20VC raised $400 M with an innovation on its venture structure and a strong media focus. Mindblowing.

Real Ventures: undisclosed amount raised. Early-stage fund focused on early-stage consumer and consumer technology.

General Catalyst is securing $6B for a new primary fund, cementing its place as a venture leader.

🍫 a reminder 🍫

That’s it for this week’s The Drop! What stood out to you? Let me know! 🐼